By Natalie Haynes, Contributor

According to Forbes, there are now more households with pets than children in the U.S. (70% vs. 66%), and we are increasingly pampering our pets with activities and luxuries formerly reserved for humans. A strong contributing factor in this trend is the fact that, compared to previous generations, Millennials are finding partners later in life and having children later in life (or not at all), and as a result, pets are increasingly humanized and treated as “family”.

This trend itself is not new. What is new is the level of spending and the array of goods and services designed to meet this market. Spending in the pet care category was $72.1 B in 2018, which is up 8% since 2016.

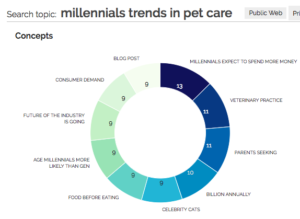

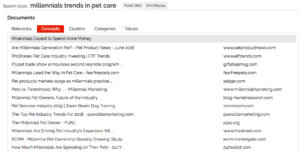

Using Metametrix to search online content about “millennials trends in pet care”, the top concept is “expect to spend more money”. Drilling down on that topic, we can see numerous articles about industry trends around this.

This search brought up hundreds of articles on this topic, but one from Nielsen especially highlights that just as millennials have tapped into health, wellness, and novelties for themselves, health, wellness, and novelties are on the rise for pets as well.

As a country, we have escalating interest in things like organic pet food, pet insurance, pet DNA tests, and pet spa days with massages and yoga classes.

Interest in using technology with pets is also increasing, and the options go well beyond cameras and tracking devices. As an example, in Brazil, one company launched a Pet-Commerce site that relies on AI and facial recognition for dogs to help them shop online.

In addition to expanding options in health, wellness, and technology, another trend is clothes for pets.

The Metametrix search above led to an article from the NRF saying, “One of the biggest trends this year is the growth of spending on pet costumes”. “Out of the 31.3 million Americans planning to dress their pets in costumes [for Halloween 2018], millennials (25-34) are most likely to dress up their pets.” And a lot of them incorporate their pet’s costume with that of their own.

People are bonding with their animals more than ever, and costumes are part of that trend.

Below is my friend Sara Lynn Michener dressed like her Great Dane, Gunter, in a “Dress Like Your Dog” contest. (They won.)

What does this mean for retail?

This is big and getting bigger.

Millennials are more willing to spend on wellness and high-ticket items for their pets than previous generations have been.

A Daily Show clip highlights this in the extreme.

In case you don’t have time for the video, it starts with “pawdicures” and ends with $170k dog houses.

This humanization trend is great for the innovative sector of this category but is hitting some legacy pet brands very hard. The largest spend in the pet category is pet food. And as people move towards considering their pet as a family member, they are shifting to higher end options, so brands like Mars’ Pedigree, Nestle’s Purina, and Smucker’s Gravy Train and Kibbles ‘n Bits are suffering.

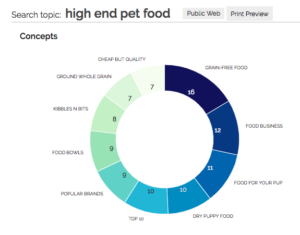

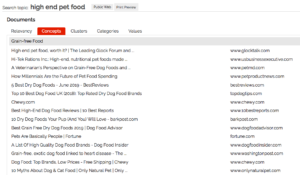

Regardless of the generation, many people want to give their pets the best. A Metametrix search on “high end pet food” shows Grain-Free Food is top of the list of concepts identified. And clicking into that concept takes us to a list of articles about this, with titles including “How Millennials Are the Future of Pet Food Spending” and “Pets Are Basically People”.

There is certainly a place for legacy brands, but that space is shrinking. People are making their own dog treats, creating raw food diets, and even having fresh pet food delivered. See best dog food delivery services here:

Some of this may seem (or be) outlandish, but as animals become more like children, consumers are going to give them the best they can. If retailers want to maintain a connection with the next generation of customers, they need to provide goods, services, and experiences that target four legged customers as much if not more than those on two.

Because the tides are shifting on how we treat our animals, successful retailers will continue to adjust to increasing scrutiny on quality, even from the government. As mentioned above, grain-free food is a popular trend in dog food, but it’s also being questioned as potentially related to canine heart disease. The FDA issued this caution recently (which is the third FDA report on this issue).

From the FDA: “Many of the reports submitted to the FDA included extensive clinical information, including echocardiogram results, cardiology/veterinary records, and detailed diet histories. The numbers… only include reports in which the dog or cat was diagnosed with DCM by a veterinarian and/or veterinary cardiologist.”

When I was a child, we didn’t have a detailed dietary history for our dog or a veterinary cardiologist. We had a shovel and a backyard. Things have definitely changed.

The FDA study on grain free food is not conclusive, but it further proves that we are generally wanting or demanding more for our pets. As this trend continues, pet parents will continue to want better and more in many domains.

Top three spends right now for this category are: Food: $30B, Veterinary $20B, Medication $16B.

After that it’s having fun with them. And a lot of retailers are already creatively tapping into this with unconventional services, like cat tea houses and pawdicures. People are paying to have their dog’s nails done while they do the same. For connecting with current pet parents, unconventional can be a strong competitive advantage, but only if they’re both getting the best.